Labels

- .

- 17 வது மாநில மாநாடு-

- 7 th TN pay comm

- AADHAR

- ANDROID APP

- BED

- CCE SYLLABUS

- CEO PROCEDINGS

- CM CELL REPLY

- COURT NEWS &JUDGEMENT COPY

- CPS

- DEE

- Departmental test

- DSE

- election commision

- EMIS

- EMPLOYMENT NEWS

- ENGENEERING

- EXAM BOARD

- FORMS

- G.O

- go

- GPF

- I.T

- IGNOU

- JACTTO GEO

- jeya

- mbbs

- NEWS PAPER POSTS

- nmms

- PAARAATU

- PAY COMMISSION

- PAY DETAIL

- Pay Detail download

- pedagogy

- PENTION

- RESULTS

- RTE

- RTI

- SCERT

- scholarship

- SLAS

- SSA

- TAMIL FONTS

- TEACHING TIPS

- TET

- TETOJAC

- TNPSC

- TPF Closure

- TPF/CPS ஆசிரியர் அரசு ஊழியருக்கு இலட்சக் கணக்கில் வட்டி இழப்பு. ஒரு கணக்கீடு.

- TRANSFER-2015

- TRANSFER-2016

- TRANSFER-2018

- TRB

- UGC

- university news

- ஆங்கிலம் அறிவோம்

- ஆசிரியர் பேரணி

- இளைஞரணி மாநாடு-2017

- கட்டுரை

- கணிதப்புதிர்

- கூட்டணிச்செய்திகள்

- தமிழ்நாட்டு இயக்க வரலாறு-புத்தகம்

- பொது அறிவு செய்திகள்

- பொதுச்செயலரின் புகைப்படங்கள்

- மருத்துவக்குறிப்பு

- விடுப்பு விதிகள்

- வீடியோ பாடங்கள்

- ஜாக்டோ

WHAT IS NEW? DOWNLOAD LINKS

- அரசு ஊழியர் மற்றும் ஆசிரியர் NHIS :-2017 CARD Download

- How to know Annual income statement pay slip, pay drawn particulars?

- TPF/CPS /GPF சந்தாதாரர்கள் ஆண்டு முழுச் சம்பள விவரங்கள் அறிய

- Income Tax -2018 calculator-(A4-2page with form16)

தேர்தலில் தபால் வாக்கு எப்படி அளிப்பது என தெரிந்துக்கொள்ள உங்களுக்கு உதவும்

👆14/4/2019 தேர்தல் பயிற்சி வகுப்பு 13.4.2019 க்கு மாற்றம்

*தேர்தல் வாக்குப்பதிவு நடைபெறவுள்ள ஏப்ரல் 18 ஆம் தேதி அரசு விடுமுறை..*

தேர்தல் பணிகளில் அரசு ஊழியர் வதைபடுவது தொடரக் கூடாது!*

🌀🌀நடக்கவிருக்கும் மக்களவை மற்றும் சட்டமன்ற இடைத்தேர்தலில், வாக்குச்சாவடிகளில் பணியாற்றும் அலுவலர்களுக்கு முதற்கட்ட பயிற்சி வகுப்புகள் நடந்து முடிந்திருக்கின்றன. இன்னும் இரண்டு கட்டங்களாக இந்தப் பயிற்சிகள் நடத்தப்படவிருக்கின்றன*

*🌀🌀ஆனால், பெரும்பாலான அரசு ஊழியர்கள் தாங்கள் தேர்தல் பணிகளில் ஈடுபடுத்தப்படுவதை விரும்பவில்லை. அரசு ஊழியர்களின் இந்தத் தயக்கத்துக்கான காரணங்களைப் பரிசீலிக்க, தேர்தல் ஆணையம் முன்வர வேண்டியது அவசியம்*

*🌀🌀வாக்குப் பதிவு அலுவலர்கள் அரசியல் கட்சிகளின் வாக்குச்சாவடி முகவர்களிடமிருந்து உணவுப்பொருட்களைப் பெறுவது கூடாது என்று அறிவுறுத்தப்பட்டுள்ளது*

*🌀🌀உணவைத் தங்களது சொந்தப் பொறுப்பில் ஏற்பாடு செய்துகொள்ள வேண்டும் என்று கூறியிருப்பது நடைமுறையில் வேடிக்கையானதும்கூட. வாக்குச்சாவடிகளில் பணிபுரியும் அலுவலர்கள் அங்கிருந்து நகர முடியாத அளவுக்கு முழுப் பொறுப்பை ஏற்றுக்கொண்டிருக்கிறார்கள். அவர்களுக்கு உணவு ஏற்பாடு செய்யக்கூடத் தேர்தல் ஆணையத்தால் முடியாதா என்ன?*

*🌀🌀வாக்குப் பதிவு அலுவலர்கள் தேர்தலுக்கு முதல் நாளே வாக்குச்சாவடிகளில் தங்க வேண்டியிருக்கிறது*

*🌀🌀வாக்குப் பதிவு முடிந்து அன்றைய இரவு வாக்குப் பதிவு இயந்திரங்களைப் பாதுகாப்பாக அனுப்பிவைப்பது வரைக்கும் அவர்கள் வாக்குச்சாவடிகளில் காத்திருக்க வேண்டும். அநேகமாக நள்ளிரவு வேளைகளில்தான் அவர்கள் கிளம்ப முடியும்*

*🌀🌀போக்குவரத்து வசதியற்ற பகுதிகளில் பணியாற்றுபவர்களுக்கும்கூடத் தேர்தல் ஆணையம் எந்த ஏற்பாடுகளையும் செய்வதில்லை*

*🌀🌀தொடர்ந்து ஏறக்குறைய மூன்று நாட்களுக்கு ஓய்வின்றி பணிபுரிய வேண்டியிருக்கும் அந்த அலுவலர்களுக்கு உணவு, போக்குவரத்து ஏற்பாடுகளைச் செய்ய வேண்டியது தேர்தல் ஆணையத்தின் பொறுப்பு. சில வாகனங்களை ஏற்பாடு செய்தால்கூடப் போதும், நூற்றுக்கணக்கான வாக்குச்சாவடிகளில் பணிபுரியும் அலுவலர்களுக்கு உணவு, போக்குவரத்து வசதிகளை வழங்கிவிட முடியும்*

*🌀🌀பெரும்பாலும் வாக்குச்சாவடிகள் என்பது அந்தந்தப் பகுதிகளில் உள்ள அரசுப் பள்ளி கட்டிடங்களாகவே இருக்கின்றன. அனைத்துப் பள்ளிகளிலுமே கழிப்பறை வசதிகள் இருப்பதில்லை என்பதையும் இங்கு கவனத்தில் கொள்ள வேண்டும்*

*🌀🌀வாக்குப் பதிவில் முறைகேடுகள் நடந்தால் தொடர்புடைய அலுவலர்களைத் தண்டிப்பதற்கு வாய்ப்பிருக்கிறது என்பதால்தான் அரசு ஊழியர்கள் தேர்தல் பணிகளுக்குப் பயன்படுத்திக் கொள்ளப்படுகிறார்கள்*

*🌀🌀அப்படிப்பட்டவர்களுக்குக் குறைந்தபட்ச வசதிகளைச் செய்துதருவதில்கூடத் தேர்தல் ஆணையம் அலட்சியம் காட்டுவதை எவ்வகையிலும் நியாயப்படுத்த முடியாது

14.04.2019 அன்று தேர்தல் வகுப்பு இல்லை...

DEE-பள்ளிகளில் காலை இறைவணக்கக்கூட்டத்தில் சாலை பாதுகாப்பு உறுதிமொழி எடுத்தல் -இயக்குனர் செயல்முறைகள்

"சிறந்த அறிவியல் ஆசிரியர் விருது " ஆசிரியர்கள் விண்ணப்பிக்கலாம் - Instructions & Application - இயக்குனர் செயல்முறைகள்

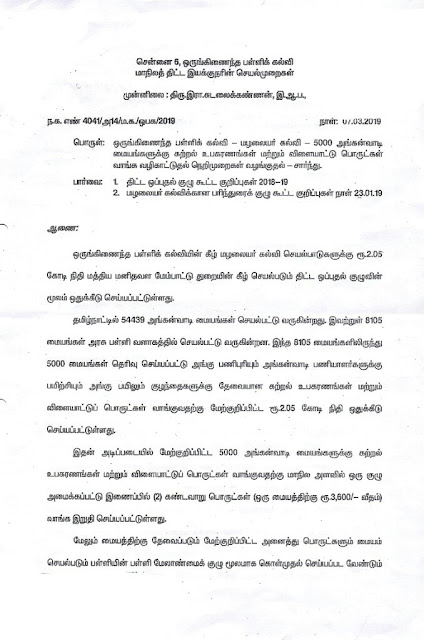

SSA-SPD PROCEEDINGS-ஒருங்கிணைந்த பள்ளிக் கல்வி - மழலையர் கல்வி-5000 அங்கன்வாடி மையங்களுக்கு கற்றல் உபகரணங்கள் மற்றும் விளையாட்டு பொருட்கள் வாங்க வழிகாட்டுதல் நெறிமுறைகள் வழங்குதல் - சார்ந்து.

தேர்தல் பணி காரணமாக ஆரம்பப் பள்ளிகள் 210 நாட்களாக இயங்குவதில் சிக்கல் தவிர்ப்பாணை வழங்க வலியுறுத்தல்

25.03.2019 விசாரணைக்கு வந்த ஜாக்டோ ஜியோ வழக்கு விசாரணைக்கு பின்பு 08.04.2019-க்கு ஒத்திவைப்பு.

வருமான வரி மாதா மாதம் பிடித்தம் செய்யவேண்டும்.

தமிழ்நாட்டு ஆசிரியர் இயக்க வரலாறு-ஆசிரியர் செ.முத்துசாமி- தொடர்-3

*விழுப்புரம் மாவட்டம் முதல் கட்ட தேர்தல் வகுப்பு பயிற்சி வரும் ஞாயிறு* 24.3.2019

7th Std மட்டும் SLAS test ஏப்ரல் மாதம் 9ஆம் தேதிக்கு தள்ளி வைக்கப்பட்டுள்ளது.மாவட்டத்தில் உள்ள அனைத்து அரசு மற்றும் அரசு உதவி பெறும் பள்ளிகளில் உள்ள அனைத்து மாணவர்களுக்கும் இத்தேர்வு நடத்த திட்டமிடப்பட்டுள்ளது.

TNTET - PAPER - 1 & 2 - SYLLABUS

CLICK HERE TO DOWNLOAD - TET PAPER - 1 SYLLABUS

CLICK HERE TO DOWNLOAD - TET PAPER - 2 SYLLABUS

ELECTION 2019 - தேர்தல் பயிற்சி வகுப்புகள் விவரம் | OFFICIAL LETTER Proposed Schedule for Election Class Training

TET தேர்வு ஆன்லைனில் விண்ணப்பிப்பது தொடர்பான சந்தேகங்களுக்கு உதவி எண் (HELP LINE NO) அறிவிக்கப்பட்டுள்ளது.

BE - பொறியியல் படிப்புகளில் சேர்வதற்கான குறைந்தபட்ச தகுதி மதிப்பெண்களில் மாற்றம் - அண்ணா பல்கலைக்கழகம் அறிவிப்பு

தனியார் பள்ளிகளில் IFHRMS திட்டத்திற்கு தடை சென்னை உயர்நீதிமன்றம் உத்தரவு